AUDUSD SIGNAL : AUSTRALIAN DOLLAR, AUD/USD, CHINA GDP, DATA, PBOC, COMMODITIES – TALKING POINTS

AUDUSD SIGNAL : AUDUSD Chinese GDP printed at 4.0% year-on-year for the fourth quarter against expectations of 3.3% and 4.9% previously.

Other Chinese data was released at the same time, with industrial production for the year to the end of December coming in at 4.3% instead of 3.7% anticipated and 3.8% prior. Retail sales numbers for the same period were 1.7% below the 3.8% forecast and 3.9% previously.

This comes on the heels of a much better trade balance report seen last week. The data showed imports were down, but exports were surging through December to record a better than expected trade surplus of USD 94.46 billion instead of USD 73.95 anticipated.

Today’s growth figures would come as a welcome relief to the Peoples Bank of China (PBOC), as they had been under pressure to ease monetary policy. This could give them some breathing space, though some smouldering growth impediments are lingering.

The impact of the Omicron variant of Covid-19 on economic activity is exasperated by China’s “zero-case” policy. Additionally, the Chinese property sector is facing a credit crunch after a record number of defaults in the industry last year.

While the reserve requirement ratio (RRR) for banks was cut in December, freeing up more cash in the financial system, it appears more easing might be required.

Even with a better-than-expected GDP number, the result is low by comparison to where potential Chinese growth is perceived to lie.

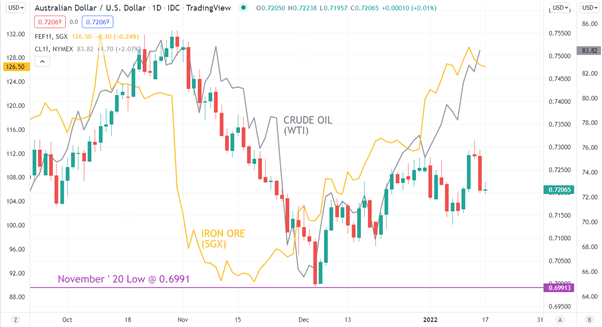

Despite this, commodity prices have been recovering of late. Iron ore and energy commodities in particular have been robust, and this may help the Australian Dollar in the near term.

Should the focus of the Chinese Communist Party (CCP) move further away from regulatory crack downs and more toward pro-growth policies, commodity markets would likely be beneficiaries of such a move.

In that environment, the high beta currency pair of AUDJPY could be the focus if there are more upside surprises for growth.

Confuse Which Broker is best ? , Here you can find the best regulated broker

AUDUSD SIGNAL : AUSTRALIAN DOLLAR, AUD/USD, CHINA GDP, DATA, PBOC, COMMODITIES – TALKING POINTS

AUDUSD SIGNAL : AUDUSD Chinese GDP printed at 4.0% year-on-year for the fourth quarter against expectations of 3.3% and 4.9% previously.

Other Chinese data was released at the same time, with industrial production for the year to the end of December coming in at 4.3% instead of 3.7% anticipated and 3.8% prior. Retail sales numbers for the same period were 1.7% below the 3.8% forecast and 3.9% previously.

This comes on the heels of a much better trade balance report seen last week. The data showed imports were down, but exports were surging through December to record a better than expected trade surplus of USD 94.46 billion instead of USD 73.95 anticipated.

Today’s growth figures would come as a welcome relief to the Peoples Bank of China (PBOC), as they had been under pressure to ease monetary policy. This could give them some breathing space, though some smouldering growth impediments are lingering.

The impact of the Omicron variant of Covid-19 on economic activity is exasperated by China’s “zero-case” policy. Additionally, the Chinese property sector is facing a credit crunch after a record number of defaults in the industry last year.

While the reserve requirement ratio (RRR) for banks was cut in December, freeing up more cash in the financial system, it appears more easing might be required.

Even with a better-than-expected GDP number, the result is low by comparison to where potential Chinese growth is perceived to lie.

Despite this, commodity prices have been recovering of late. Iron ore and energy commodities in particular have been robust, and this may help the Australian Dollar in the near term.

Should the focus of the Chinese Communist Party (CCP) move further away from regulatory crack downs and more toward pro-growth policies, commodity markets would likely be beneficiaries of such a move.

In that environment, the high beta currency pair of AUDJPY could be the focus if there are more upside surprises for growth.

Confuse Which Broker is best ? , Here you can find the best regulated broker