GOLD TECHNICAL ANALYSIS

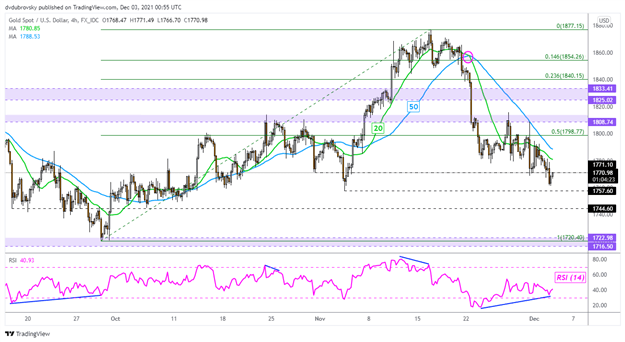

On the 4-hour chart, gold remains in a near-term downtrend since topping in the middle of November. Guiding XAU/USD lower has been the near-term 20- and 50-period Simple Moving Averages (SMAs). These may come into play in the event of a turn higher, pivoting prices back lower. Positive RSI divergence is showing that downside momentum is fading, and that can at times precede a turn higher. Otherwise, downtrend resumption places the focus on lows from September.

Gold prices fell slightly over the past 24 hours, driven by a climb in the US Dollar alongside front-end Treasury yields. The anti-fiat yellow metal can be quite sensitive to the direction of the Greenback and bond rates, especially when both are heading in the same direction. The 2-year yield continued recovering from sizeable losses towards the end of last month on Omicron Covid-19 variant woes.

During Thursday’s Wall Street session, a slew of Fedspeak reiterated the possibility of a more hawkish central bank. Raphael Bostic, president of the Atlanta branch, noted that policy will be guided by data. Meanwhile, Mary Daly, president of the San Francisco branch, noted that the central bank ‘may need to’ taper asset purchases faster than anticipated.

XAU/USD is thus turning its focus to Friday’s non-farm payrolls report. A strong employment report, particularly if average hourly earnings surprises higher, could further boost hawkish monetary policy expectations. That may cause the US Dollar to climb alongside front-end government bond yields. This could spell trouble for the anti-fiat yellow metal, raising volatility risk over the coming 24 hours.