Rating 1

Shua-Capital.com is a scam, and we are going to prove it in the following review.

RECOMMENDED FOREX BROKERS

Don’t put all your eggs in one basket. Open trading accounts with at least two brokers.

Shua-Capital.com claims to be a global trademark with a unique vision to provide advanced trading conditions, education, and state-of-the-art forex tools. Well, it does none of it. In fact, we didn’t even put “their” logo as it’s stolen from a reputable engineering business headquartered in Dubai. Shua-Capital.com is a scam, and we are going to prove it in the following review.

Shua-Capital.com REGULATION AND SAFETY OF FUNDS

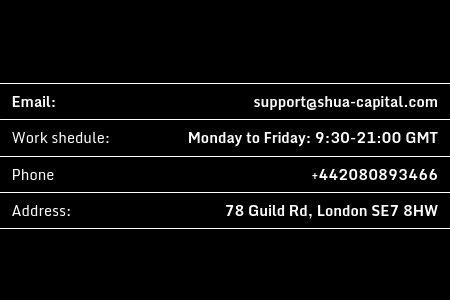

While assessing the broker, we found tons of fraudulent claims proving it’s nothing else but a scam scheme worth being avoided. First of all, it gives a UK headquarter address, so to operate legally, it needs a license issued by the local regulator FCA- it has none!

Secondly, it states to be a brand of Seldon Investments Limited- a company registered and regulated in Jordan. We tracked the company, but it has nothing to do with Shua-Capital.com as its brand is WindsorBrokers, that’s also licensed in Belize, Seychelles and Cyprus. So, Shua-Capital.com is a clone firm impersonating an authentic business aiming to mislead customers. That’s a scam!

Then, note on the screenshot above that the broker reviewed introduces another company purportedly registered in the EU to process payments for the broker. Well, there is no such European company, and we couldn’t find anything else about it, too. So, Shua Capital (WB) Global Ltd is either fictitious or a shell company that’s totally anonymous and inaccessible. Whatever the case, though, that’s a scam!

Shua-Capital.com TRADING SOFTWARE

Shua-Capital.com pretends to offer MetaTrader4, but that’s a blatant lie, as it comes with a Webtrader only, that’s actually inferior to MetaTrader. As we are reviewing a scam, we’d like to offer the high-rated MetaTrader4 brokers and MetaTrader5 brokers on both lists instead. We put MTs forward as the terminals in question deliver peerless advantages- reliable indicators, easy-to-use charting tools and sophisticated features such as Expert Advisors.

The trading costs are seemingly low- the EUR/USD spread is around 0.7 pips most of the time ($7 per lot traded). However, that’s irrelevant in this case, and it’s even a downside because many people can get into the scheme because of the favourable trading conditions.

Shua-Capital.com DEPOSIT/WITHDRAW METHODS AND FEES

The minimum deposit is $500 allegedly via Credit/Debit cards and Wire Transfers. Out of both, the first-mentioned allows chargebacks, so people who unfortunately deposited with Shua-Capital.com at least have a chance to get their money back. On the contrary, Wires are final and non-refundable, and we generally do not recommend this method when it comes to depositing with Forex brokers.

Discussing withdrawals isn’t worthwhile in this case, but we’ll focus on two bogus clauses that the broker may actually use to reject withdrawals and pillage trading accounts. Namely, according to the bonus clause, clients need to trade each bonus dollar 20 000 times to withdraw funds. Too much!

The other one is the dormancy clause that’s called Expiry of the profile. It states that clients will be charged $36 per month for inactivity after only a month with no trading. That’s a scam!

HOW DOES THE SCAM WORK

We exposed Shua-Capital.com as fraudulent in this review, and now we’ll shortly describe how Forex scams usually happen. We strongly believe that Shua-Capital.com deploys the same or very similar tactics to rip people off their hard-earned money.

So, scammers are prowling online, and they create fraudulent websites, social media profiles and ads to get people into the fraud. Once you get trapped, they will pretend to handle your account and display winning trades to make you believe it’s worth dealing with them. However, scammers won’t let you withdraw profits but will constantly urge you to deposit, again and again, asking for much greater sums. Make no mistake about it; those criminals will try to squeeze as much as possible from you, so they’ll advise you to invest as much as possible.