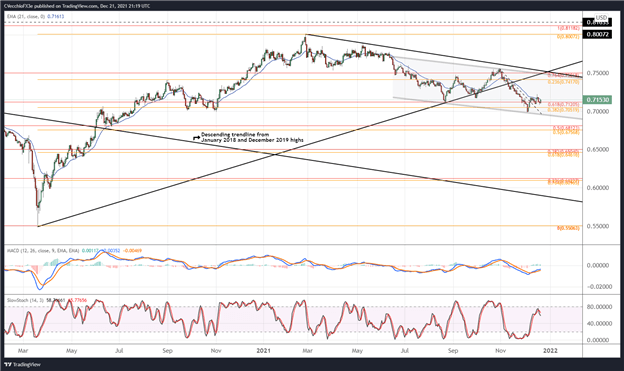

AUD/USD rates are still in the throes of two longer-term bearish technical developments: the descending parallel channel in place since the end of June; and the breakdown below the rising trendline from the March 2020 and August 2021 lows.

But the near-term technical outlook has improved, insofar as the downtrend from the October and November swing highs has been broken, and price action has yielded a flag after the nascent move higher. Furthermore, AUD/USD rates are basing above a cluster of Fibonacci levels: the 61.8% retracement of the 2018 high/2020 low range at 0.7121; and the 38.2% retracement of the 2020 low/2021 high range at 0.7052.

Momentum indicators are indecisive, however. AUD/USD rates are intertwined among their daily EMA envelope: above the 5-, 8-, and 13-EMAs, but still below the daily 21-EMA. Daily MACD continues to rise but remains below its signal line, while daily Slow Stochastics are shifting sideways, above their median line but not yet in overbought territory. A move above the December closing high at 0.7184 would offer a confirmation signal that the next leg higher has begun.

AUD/USD: Retail trader data shows 68.59% of traders are net-long with the ratio of traders long to short at 2.18 to 1. The number of traders net-long is 2.84% higher than yesterday and 3.60% higher from last week, while the number of traders net-short is 1.42% higher than yesterday and 24.34% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bearish contrarian trading bias.